Both the Marshalian cardinal utility theory of demand and Hicks-Allen indifference curve analysis provide psychological explanation of consumer’s demand. They derive laws about the consumer’s demand from the consumers reaction psychologically to contain hypothetical changes in price and income but the revealed preference theory which has been put forward by Prof Samuelson seeks to explain consumers demand from his actual behavior in the market at various prices and income situation.

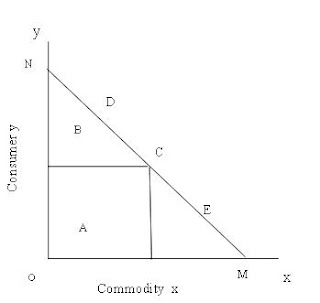

The basic idea of the revealed preference theory is very simple. Let us suppose that the consumer purchases some commodities either because he likes them more than other commodities or because they happen to be cheaper than other commodities, let us assume that there are two combinations of commodities, there is x and y, the consumer buys combination x and not combination y. From this action of the consumer we should not conclude the combination x is cheaper than combination y nor we should conclude that the combination y is inferior to combination x. If both the combinations are equally good and equally costly even then the consumer buys x combination. The conclusion is obvious, the consumer purchases x combination because he likes it better. By buying the consumer has revealed his preference for it. It can be said that if the consumer purchases x combination rather than y and z combination and that y and z combinations are not more expensive than x combinations, the x combination of good standards reveal the preference to y and z combination. The idea underline the revealed preference theory can be illustrated in the following diagram.

In this diagram A and B are two commodities the price line N and M reflects given income and price situation for the consumer. The consumer can purchase any combination lying on the price line NM such as DCE or in alternate and he can buy any combination of the two goods lying below the price line. These are alternative combinations and the consumer is free to choose any one of them. The consumer can purchase any combination of the two goods either lying with in or on the triangle NOM known as the consumer choice triangle.

Notes provided by Prof. Sujatha Devi B (St. Philomina's College)

Notes provided by Prof. Sujatha Devi B (St. Philomina's College)